The Rwanda Revenue Authority (RRA) continues to play a critical role in Rwanda’s economic development by ensuring efficient tax collection, compliance, and public service delivery. As the country grows, RRA has increasingly leveraged technology and innovation to simplify tax processes and improve transparency.

Key Roles and Achievements

- Efficient Tax Collection

- RRA ensures timely and accurate collection of taxes, which are vital for funding public services, infrastructure, and social programs.

- Through automation and digital tools, taxpayers can file returns, pay taxes, and monitor their obligations easily.

- Digital Transformation

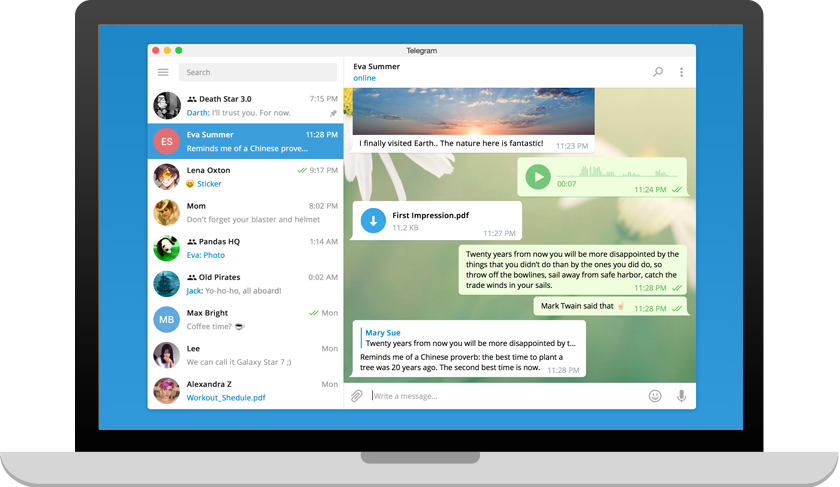

- RRA has implemented online platforms such as iTax that allow individuals and businesses to manage their taxes remotely.

- The digital approach reduces paperwork, speeds up processes, and improves taxpayer experience.

- Promoting Compliance and Education

- RRA regularly conducts awareness campaigns to educate citizens and businesses about their tax obligations.

- Through seminars, workshops, and media campaigns, the authority promotes voluntary compliance and accountability.

- Fighting Tax Evasion and Fraud

- The Authority uses advanced data analytics and investigative measures to detect and prevent tax evasion.

- Collaboration with other government agencies strengthens enforcement and ensures fair taxation.

Tips for Taxpayers

- Always register with RRA and obtain your TIN (Tax Identification Number).

- Use online platforms like iTax to file and track tax returns for convenience.

- Keep accurate records of income, expenses, and deductions to avoid issues during audits.

- Stay updated with changes in tax laws and incentives offered by RRA.

Conclusion:

The Rwanda Revenue Authority is not just a tax collection agency but a cornerstone of Rwanda’s economic growth and governance. By embracing digital solutions, promoting compliance, and ensuring transparency, RRA continues to make taxation easier and more efficient for all citizens and businesses.